Why uncapped is short-term

It is not new; by now, uncapped broadband on RF mediums has a predictable market profile. It starts with great media hype, mostly by a new telco or for a new service, full of promises and user testament of how great the service is. Then it goes quiet with the now-and-then positive publicity often linked to profitable financial result reporting. Then the beginning of the end starts, first with some ad hoc customer complaints, then lots of complaints, market outrage, media criticism and, finally, collapse of the service.

Why does this happen? Why? It is like uncapped is a sort of broadband drug for telcos. It is irresistible, with lots of short-term happiness, with an inevitable end linked to dire consequences. Uncapped is also a model where just the provider wins; even at the early stages where customers are very happy with the service, the end result win is tipped in favour of the service provider.

Uncapped broadband is like a drug for telcos. Irresistible in the beginning, with lots of happiness, leading to an inevitable negative end.

Our experience in the market has shown that this risk applies to all broadband services offered using RF communication channels. These include wireless, networks, mobile LTE, fixed LTE, satellite and even 5G. It is just a matter of time between the launch of an uncapped service and total user dissatisfaction.

The maths talks

The uncapped model is a toxic mix of complicated issues such as the science of grabbing market share, creating brand awareness in a very crowded world, getting early revenue to balance cash flows and building customer footprints, etc. While each of these areas justifies a full review, we have chosen an option where the maths does the talking. Using first order modelling, we can outline the underlining weakness of the uncapped product strategy and even calculate at what point the service will start to collapse.

Satellite use case

We will use a typical broadband satellite scenario applicable to Ka-band satellite network architecture as a reference case.

| Metric | Definition | Use Case Value |

|---|---|---|

| RF channel | RF channel defined in MHz as implemented on the Provider’s network or as contracted for this service. | 100MHz |

| Data rate | The data speed possible through this RF channel. This is a function of equipment specifications, weather patterns and network design. | 300Mbps |

| Service | The service profile promoted to the market, typically defined in speed and data bundles. NB: For this model we limit the bundles to 200GB, true UNCAPPED services are note limited at all. | 10Mbps, 200GB |

| Subscribers / channel | This is the paying subscribers per RF channel. In the case of satellite this is per beam of typically 250km coverage or span. For fixed-LTE this will be the cell tower range typically 30km. | Growth modelled from 50 to 350 subscribers / cell. |

| Service Bundle | Typical market rate for consumer broadband services with this service profiles. | R1,000 |

Quality of service outcome

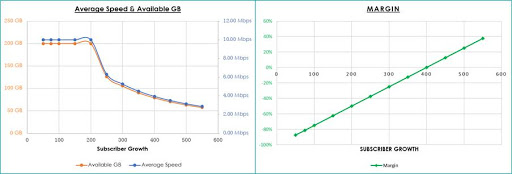

We modelled quality of service in terms of the available GB per subscriber and the average speed per subscriber. The below graphs clearly show that this model cannot scale and that sales success transferred to subscriber growth will lead to a decline in quality-of-service.

Why can this not work?

To balance this model, we need to adjust two metrics: 1) subscriber package and/ or 2) network capacity. To adjust any of the subscriber package values (data rate, or price or GB bundles) will create market kick-back and lose the advantages the provider initially promised to the market.

Profitability only starts when the subscriber data rate and GB bundle is 50% of the advertised value.

Secondly, to increase network capacity, the RF communication channel capacity must be increased, either get more spectrum from ICASA, or increase capex spend on the towers or buy more capacity on the satellite channel. All of these steps will break the initial cost models and dilute profits.

Are there alternatives?

Yes, there are options, not easy options. To balance cost and performance, more complex service management algorithms need to be implemented, underwritten by a much stronger business ethic to deliver tomorrow what you promised today and to do so for the next 10 years.

This is the option we have selected for the Twoobii broadband service – it is much more difficult to grow in the beginning; it is also much more rewarding for customers, end-users and the business in the long run.

Conclusion

Models are models, the market is the market and the competition is the competition, and we accept nothing will change soon. What is, however, hard to understand is why will credible providers promote a product strategy with such a high-risk short-term nature? Does the market truly forget and forgive so easily or can telcos simply not resist the uncapped drug as a quick fix?