World’s innovative firms struggle to stay on top

While Apple, Huawei, Samsung, Microsoft, Amazon and Alphabet have topped the most innovative companies list, even innovative firms have a hard time staying that way in the long run.

This is according to Boston Consulting Group's (BCG’s) latest report, titled: The Most Innovative Companies 2020: The Serial Innovation Imperative. The global report, released yesterday, highlights what it takes for firms to outperform over the long-term. It is based on a survey of 2 500 company executes, validated against its benchmarking database on the innovation performance of more than 1 000 firms.

It found that commitment to innovation has dropped from 79% of executives in 2019 to 63% of executives in 2020 who see it as priority – resulting in even the most innovative companies facing the challenge of making success repeatable, and a drop in rankings.

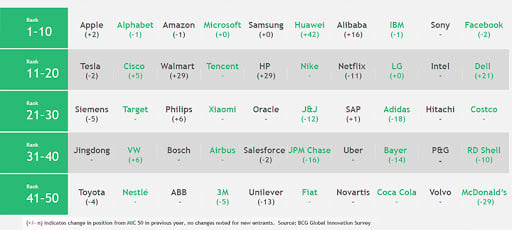

Out of 50 innovative firms, Apple dethroned Alphabet as the most innovative company, while the Google parent firm moved to second place. Amazon moved one down, ranking in third position. While IBM and Facebook also moved a few notches down, they maintained their top 10 positions.

Technology firms dominate the list, with Cisco, Siemens, Oracle, Tencent, Philips, HP, LG and Dell all featuring among the top 50.

“The research offers a more sobering assessment: serial innovation is hard. Of the 162 companies that have been on our top 50 list over the past 14 years, nearly 30% appeared just once − and 57% appeared three times or fewer,” says Michael Ringel, MD and senior partner

at Boston Consulting.

See also

A clear innovation ambition, appropriate resourcing and the ability to break industry boundaries are among challenges to establishing an innovation machine, according to the report.

Companies with mature technology

systems generate up to 20 percentage points higher innovation output; however, doing so successfully requires developing a clear innovation strategy and the appropriate investment.“Even among committed innovators, only 60% report success in solving the challenges they prioritise. All companies have plenty of room to improve but doing so may be hampered by the ‘artificial intelligence (AI) paradox’ − the ease of achieving powerful results with AI,” says BCG.

Committing to innovation

BCG says it provided respondents with a series of pointed questions, each of which focused on one of the 10 essential elements of the company’s innovation system.

According to the research, innovation is a top-three management priority for almost two-thirds of companies. This is the lowest level since the financial crisis in 2009 and 2010.

While many companies struggle to address multiple innovation challenges at once, committed innovators prioritise a handful, and as a result, address them more effectively.

“Committed innovators focus on emerging technologies such as advanced analytics, Internet of things, digital design and technology platforms – embraced for different reasons.

“Committed innovators (45%) say innovation is a top priority, and they support that commitment with significant investment. Sceptical innovators (30%) are the reverse, seeing innovation as neither a strategic priority nor a significant target of funding. And confused innovators (25%) are in between, with a mismatch between the stated strategic importance of innovation and their level of funding for it,” explains Rahool Panandiker, MD and partner at BCG Mumbai.

However, some of the world’s most innovative companies have been getting bigger. The revenue of a typical “small” company on BCG’s 2020 list of the 50 most innovative companies is $30 billion − up more than 170% from $11 billion in the first survey in 2005, it notes.

MEA innovation falls flat

In 2020, no company from the Middle East and Africa (MEA) is on the list, with the most innovative company currently being Saudi Arabian oil firm Saudi Aramco.

According to the report, innovation in the region is not yet happening at the top and there are great opportunities to be tapped into.

While 66% of MEA executives see innovation as a top three priority, only 45% align this ambition with commensurate innovation spend. These are two times more likely to outperform. Another 25% of firms clearly misalign ambition and spend, notes the report.

“Innovation efforts among Middle East and Africa firms tend to fall flat unless they have visible and credible top management support. MEA firms are mostly held back by weak project management innovation system setup and a degree of 'non-consensus' among top management and IT teams.”